Overarching Themes of Industries of Opportunity

The location and nature of jobs in Industries of Opportunity can make transportation choices more challenging to provide.

Many Industries of Opportunity are geographically scattered, making it harder to serve those jobs with public transit. Or, they are located in parts of the region that have not traditionally been transit hubs. Office, research and development, and light industrial parks that house industries including biotech, information technology, energy, and manufacturing firms typically consist of sprawling landscapes with plentiful parking; many are located near freeway off-ramps. Employers make locational decisions based on a variety of factors, including where zoning allows them to operate, where the price of land accommodates their bottom line, and where other businesses in their supply chain or with similar models operate. If it were possible for more of these facilities to locate nearer to transit, or if enhanced transit service could be provided to these locations, jobs in these industries would be more accessible to low-income residents.

Also, the hours of worker shifts do not always align with peak transit hours. Healthcare jobs, if located in compact environments near transit, provides benefits not only to healthcare workers but to people in the region seeking healthcare services. Healthcare workers tend to work off-peak shifts, making it more difficult for workers to use transit. Jobs in the manufacturing and transportation industries also have shifts that do not align to typical peak transit hours.

However, making these industries more transit-accessible is crucial to supporting the regional economy.

Workers with shorter, less stressful commutes are more productive and more likely to be at work on time. One employer located near Oakland International Airport found that as the number of employees in the company increased from 11 to 800, the workforce is traveling from homes as far away as Antioch and Brentwood—and that those long commute distances have started to impact job quality.

The transportation sector is an important service sector for other industries in the region and many transportation jobs offer living wages and low barriers to entry. However, the trend of these firms moving to less expensive land outside of the region has major access implications, for both firms which need the services provided by transportation companies and for the lower-income workers who want access to high-quality jobs.

Some industrial land with decent transit connections is under threat of conversion to residential or commercial development as land values near transit rise. Maintaining industrial land to support the region’s growth sectors (including knowledge and IT related work) will be important for the region’s competitiveness moving forward.

The preference of need by some Industries of Opportunity for low-density, large floor plate, low-rise buildings or large sites presents a challenge to increasing transit access.

Rethinking the types of buildings in which these industries could operate in offers one way of improving the potential of increasing transit access to jobs. Higher density buildings with smaller footprints can be more easily clustered near transit or in nodes. However, the cost of vertical construction may be a barrier to this approach.

Industries of Opportunity interconnect and overlap each other.

The healthcare and transportation sectors serve workers from all sectors in the region, including the other Industries of Opportunity. Additionally, the biotech, energy, and information technology sectors, while being closely related themselves, include some manufacturing jobs. Likewise, IT jobs are of growing importance in the Healthcare sector, as well as other Industries of Opportunity.

This interconnectedness has policy and resource implications. Manufacturing processes that are difficult to export – such as computer-related product development and food – may hold long-term promise for quality jobs. Medical manufacturing and the healthcare industry may also benefit from enhancing these connections, improving the healthcare sector’s access to medical equipment and jobs in the medical manufacturing at the same time.

There is a lack of “pipeline” connections from training programs to jobs.

“There are a lot of workforce training providers… but there are no connections between community colleges/training providers and employers. The pathways are opaque.”

-Kristen Spaulding of SMCUCA

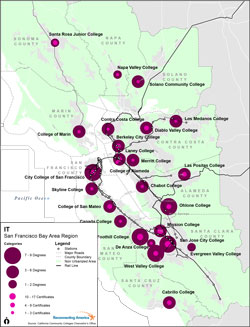

While community colleges offer industry-oriented degree and certificate programs, students often do not have good access to information about jobs in targeted industries. Transit may be one connector to supporting the development of pipelines from training to jobs (fostering access between community college programs, from community college program to internship).

Jobs within the Industries of Opportunity vary in terms of their quality and in the availability of open positions.

Each of the Industries of Opportunity offers a broad variety of occupations, with varying educational requirements, wages, and job quality. Some of these occupations meet the definition of a “career-ladder” or “middle-skill” job, while others require longer-term education such as a bachelor’s or master’s degree, or pay less than a living wage.

The sections below provide summaries of each Industry of Opportunity, including the share of total jobs within the industry that provide a living wage, and require a “middle skill” education. They also highlight some of the challenges to better connecting these industries to transportation alternatives such as transit, walking and biking.

Nationally, manufacturing has experienced significant drops in employment, but the sector has seen some job recovery since 2010., In the Bay Area, the share of jobs (based on the North American Industry Classification System (NAICS) categories) in manufacturing has fallen over the last ten years, but more slowly than the rest of the US, giving the region a competitive advantage.

Most manufacturing in the Bay Area requires workers to operate computer-based machinery rather than engage in manual work along an assembly line. This type of production is known as “advanced manufacturing.” Most production jobs that support the high tech sector, particularly in the computer and electronics industries, involve advanced manufacturing. These jobs tend to be located in and around Silicon Valley.

Food manufacturing, concentrated in North and East Bay counties, is also an important regional industry. San Francisco includes clusters of both advanced manufacturing and food manufacturing facilities.

Education and training are important to the manufacturing sector. There are a large number of replacement job openings in the Bay Area, that is, demand for new workers as older workers retire. Because advanced manufacturing requires a high level of skill and education, it draws from a population of highly skilled workers, making the need for workforce development and education vital.

Land use planning also has an impact on manufacturing. Some cities in the region have taken steps to preserve industrial land from conversion to other uses that can command higher land values. However, this is an area of debate in many localities, particularly in areas such as transit-rich locations that might otherwise be considered high priorities for higher density mixed-use infill development, including housing.

Job Quality

In the Bay Area, the quality of jobs within advanced manufacturing and food manufacturing firms is highly variable depending on the goods being produced. Manufacturing of machinery, computers and electronics, transportation equipment, and beverages have a moderate to high share of jobs that pay a living wage and that require a range of skills. Garment production and furniture manufacturing do not pay well despite requiring some level of experience and on-the-job-training. Food manufacturing varies in its job quality. Overall in the region, only 15% of workers in food manufacturing earn a living wage, and the majority of jobs are low-skill, requiring a high school degree or less. However, the quality of similar jobs can differ significantly from firm to firm. For example, some specialized food production firms pay living wages and provide benefits and on-the-job training.

Inner City Advisors, an education and workforce consulting group that focuses on growing small businesses that offer quality jobs, works with firms involved in specialized food production. Revolution Foods, one of their first clients, went from a staff of 11 employees to more than 800, and provides quality jobs, by hiring from the communities it serves, providing opportunities for growth, paying fair wages and benefits, and using an employee ownership model.

Transit Challenges and Opportunities

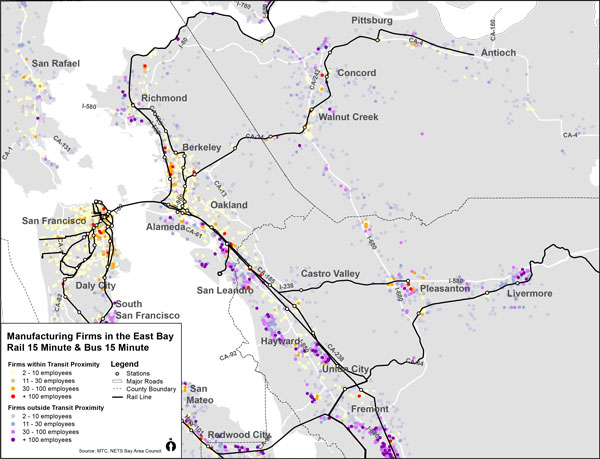

There are several signficant clusters of advanced manufacturing and food manufacturing jobs in the East Bay and South Bay, including south Fremont and the area surrounding the future Warm Springs BART station, where about 7% of all jobs in these two sectors are located. Other clusters include the corridor stretching across Sunnyvale and Santa Clara (10% of jobs in these sectors) and North San Jose (16% of jobs in these sectors). While these clusters contain a significant portion of advanced manufacturing and food manufacturing jobs, they are less dense than more walkable job centers such as downtown Oakland and San Jose. This is also reflected in the regional sector measurements of density shown at right.

This low to moderate density, which can be attributed to a need for large floor plates and potentially negative externalities associated with manufacturing (noise,odor, truck traffic, etc), can create a challenge in linking manufacturing jobs to transit. About 37% of jobs in advanced manfacturing and food manufacturing (about 112,125 jobs) are located near high quality transit. That is lower than the share of jobs near transit for all industries in the region (51%). Together, advanced manufacturing and food manufacturing rank third best among Industries of Opportunity in transit accessibility.

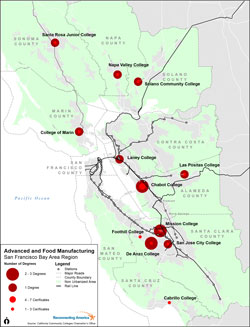

Figure 1. Advanced and Food Manufacturing Firms Proximity to Transit

Workforce Profile

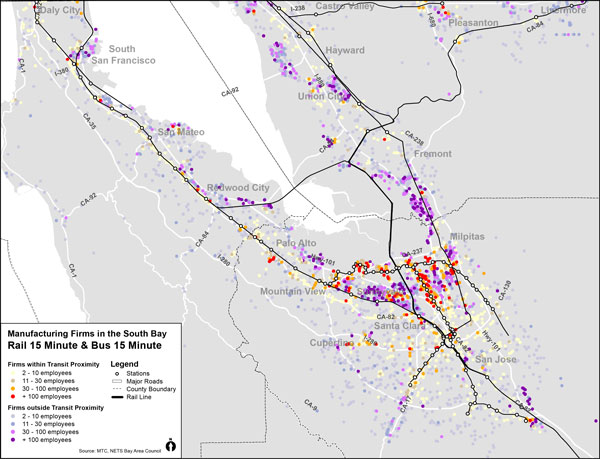

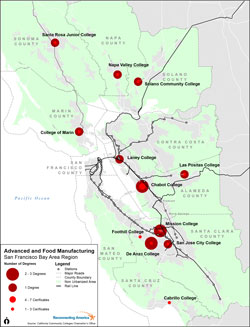

Figure 3. Workforce Training Locations in Advanced and Food Manufacturing.

From the workforce development perspective, advanced manufacturing and food manufacturing are well-established as industries that offer living wages and career-ladder opportunities for workers. Union organizing through the last century played an important role in increasing the quality of these jobs, and this continues to be true today. The Career Advancement Academies in the Contra Costa and Peralta community college districts identified advanced manufacturing and food manufacturing as industries they focus on for curriculum development. In the Bay Area, community colleges offer 12 certificate programs and 10 degree programs in advanced manufacturing and food manufacturing. However, only seven of those colleges are near quality, high-frequency transit, meaning that workers who can’t afford a car may have difficulty accessing the full spectrum of programs offered.

Key Issues

- Commuting: Linking the residents who live near these job clusters to nearby training and jobs is critical to supporting the region’s economy. Employees are traveling from homes as far away as Eastern Contra Costa County—and these long commute distances have started to impact job quality.

- Long-term viability of manufacturing in the US: The focus on manufacturing processes that are difficult to export, such as computer-related processes related to product development, food manufacturing, and, as Kristen Spaulding at SMCUCA has pointed out—linking the healthcare industry with medical manufacturing in terms of economic and workforce development connections, might be one approach to thinking about the future of manufacturing in the US. The Urban Future of Work, a 2012 report by SPUR, argues that maintaining industrial land to support the region’s growth sectors (including knowledge and IT related work) will be important for the region’s competitiveness moving forward.

Wages and Skill Levels in Advanced Manufacturing and Food Manufacturing

NAICS

Code |

Description |

% Paying

> $18.50

an hour |

%

Low

Skill |

%

Middle

Skill |

%

High

Skill |

| 333 | Machinery Mfg | 55% | 13% | 66% | 21% |

| 334 | Computer and Electronic Product Mfg | 74% | 13% | 37% | 51% |

| 335 | Electrical Equipment, Appliance, and Component Mfg | 43% | 27% | 56% | 17% |

| 336 | Transportation Equipment Mfg | 73% | 7% | 55% | 38% |

| 337 | Furniture and Related Product Mfg | 23% | 17% | 79% | 4% |

| 311 | Food Mfg | 15% | 65% | 33% | 2% |

| 312 | Beverage & Tobacco Product Mfg | 51% | 42% | 50% | 8% |

| 3399 | Misc Mfg | 40% | 17% | 70% | 13% |

| 8113 | Commercial/Industrial Machinery and Equipment Repair and Maintenance | 78% | 13% | 80% | 6% |

The Transportation and Warehousing sector is a crucial industry supporting the Bay Area’s economic prosperity. It includes the airports and the Port of Oakland, as well as ancillary transportation hubs. Total Bay Area employment in this sector has declined from 3.8% of the region’s jobs in 2000 to 3.0% in 2011, reflecting national trends. However, the sector has seen an increase in the number of jobs since 2010 and the Bureau of Labor Statistics projects job growth of 1.9% annually.

In the Bay Area, this decline in transportation and warehousing jobs over the past decade may reflect the relocation of these industries to less expensive locations outside of the region. This has implications for the greenhouse gas emission and vehicle miles traveled goals set by the State of California in AB 32 if workers in these jobs living in the Bay Area are forced to drive to their jobs outside of the region.

By supporting all other sectors, transportation and warehousing plays a pivotal role in the Bay Area economy and is a focus of local and regional economic development efforts. In particular, the Port of Oakland is a crucial hub for commerce in California and the Western United States.

Job Quality

The quality of jobs in the transportation and warehousing sector differs within the industries included in this sector and from firm to firm. There is a high share of jobs related to truck transportation, transportation support activities, and machinery/equipment rental that pay a living wage, with a mix of low and middle skill educational requirements. Overall, this sector tends to have a lower educational barrier to entry, with few jobs requiring a college degree, and most requiring a mix of low and middle skills. Truck transportation has one of the highest shares of jobs paying a living wage and also has one of the highest concentrations of jobs requiring only a high school degree. While trucking has historically been a high-paying occupation, interviews suggest that wages and job stability are declining. The warehousing and storage sectors have the lowest share of jobs paying a living wage and the highest share of low-skill jobs compared to other sectors.

The East Bay Alliance for a Sustainable Economy (EBASE) is interested in the transportation and warehousing sector because of the yet unrealized potential for quality jobs in both transportation and repackaging of imported goods. EBASE has identified transportation as one sector that “[represents] a mix of job qualities. Some jobs in this category provide high wages and benefits supported by collective bargaining agreements, while others remain low-wage jobs with little security and opportunity for advancement. If guided by responsible economic development and targeted hiring policies, these jobs can be directed to provide real opportunities for those struggling the most in the East Bay.”

Transit Challenges and Opportunites

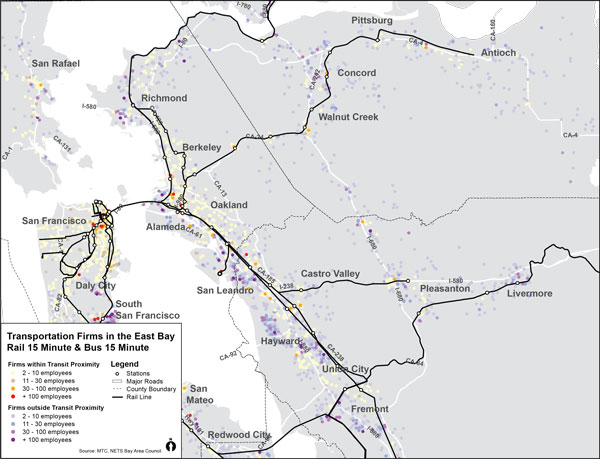

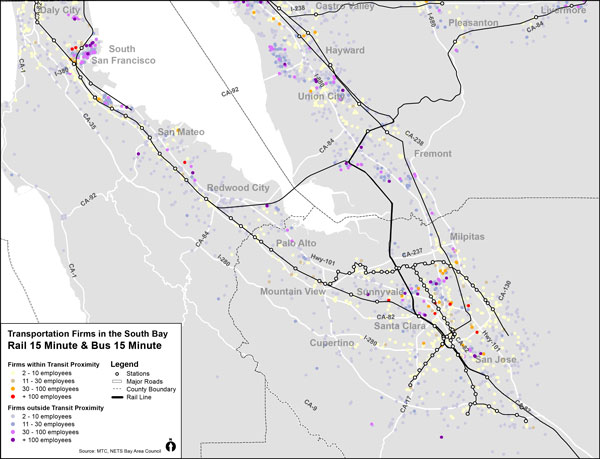

Like manufacturing jobs, jobs in transportation and warehousing tend to be dispersed. As the table at right shows, transportation and warehousing jobs are the least clustered of all of the Industries of Opportunity. The largest concentration of these jobs is in and around the San Francisco Airport (around 9% of the jobs in this sector), with smaller clusters in North San Jose, Hayward, San Leandro, in and around the Oakland Airport and the Port of Oakland.

This low to moderate density can create a challenge in linking jobs to transit. About 32% of jobs in this sector (about 20,400 jobs) are located near fixed-guideway stations or bus stops. Though this share is similar to some of the other Industries of Opportunity (including Energy and Manufacturing), it is significantly lower than the share of jobs near transit for all industries in the region (51%).

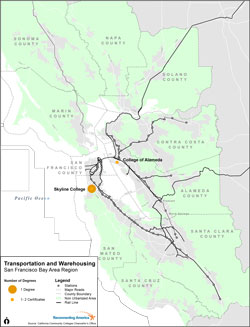

Figure 4. Transportation and Warehousing Firms Proximity to Transit

Workforce Profile

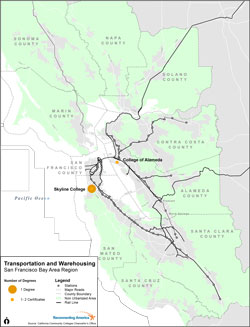

Figure 6. Workforce Training Locations in Transportation and Warehousing

As one of the few Industries of Opportunity that is not a focus of workforce development providers, the transportation and warehousing sector has few certificate and degree programs in the community college system. However, the two community colleges that do provide certificate and degree programs in this sector, Skyline College and the College of Alameda, are both located near major hubs of transportation and warehousing jobs, including San Francisco International Airport and Oakland International Airport. However, only the College of Alameda is located near high-frequency transit.

Key Issues

Transportation and warehousing sector jobs have the potential to be high quality jobs, since many offer living wages and low barriers to entry. However, as firms in this industry relocate jobs to less expensive land outside of the region, they become harder for local low-income workers to reach. Customers of these firms may also find transportation and warehousing services harder to access.

Wages and Skill Levels in Transportation and Warehousing

NAICS

Code |

Description |

% Paying

> $18.50

an hour |

%

Low

Skill |

%

Middle

Skill |

%

High

Skill |

| 481 | Air Transportation | 35% | 30% | 68% | 2% |

| 483 | Water Transportation | N/A | N/A | N/A | N/A |

| 484 | Truck Transportation | 74% | 76% | 21% | 4% |

| 486 | Pipeline Transportation | N/A | N/A | N/A | N/A |

| 488 | Support Activities for Transportation | 73% | 44% | 49% | 7% |

| 492 | Couriers and Messengers | N/A | N/A | N/A | N/A |

| 493 | Warehousing and Storage | 28% | 79% | 18% | 4% |

| 5324 | Commercial and Industrial Machinery and Equipment Rental and Leasing | 70% | 38% | 50% | 13% |

Blank fields were unavailable within the CA EDD Data |

The biotech sector occupies a very significant place in the Bay Area’s economy. Biotech jobs encompass a range of jobs supporting research and innovation in the use of biological materials. This field ranges from pharmaceutical production to exploration of potential biofuels. This is a growing innovation industry in the region and the country, and is particularly strong in the East Bay, which was home to the world’s first biotechnology company, Cetus, in 1971. Today, the East Bay is the nation’s fifth largest biotechnology cluster, according to the East Bay Economic Development Alliance. Recently, the Lawrence Berkeley National Laboratory chose Richmond as the home of its new biofuels-focused campus, signaling the strength of this sector. This new lab has the potential to strengthen the regional bioscience cluster and act as a catalyst for regional economic development, while providing key workforce development opportunities for Richmond residents.

The North American Industry Classification System (NAICS) does not classify biotech as a single industry, and biotech jobs fall under a variety of traditional industry definitions. The analysis in this work includes industries

listed under the professional, scientific and technical services, manufacturing, and healthcare categories. There is

a significant overlap in the industries encompassing biotech and information technology.

Biotech is a focus of economic development agencies including the East Bay Economic Development Alliance (EBEDA) and of educational organizations such as the Community College Consortium. The success of this sector is also tied closely to the continuing viability of other more traditional sectors in the region, including medical equipment manufacturing activities, for example.

Job Quality

In all subsectors examined, a majority of biotech jobs in the Bay Area pay a living wage to employees. There are some subsectors such as research and development that have a high educational barrier, requiring a college degree for entry, but the other components of this sector have significant shares of jobs that require middle-skill education, i.e. some on-the-job-training or an associate’s degree. Laboratory jobs, in particular, offer opportunities to middle-skill workers and are a focus of several institutions, including the San Mateo County Economic Development Association.

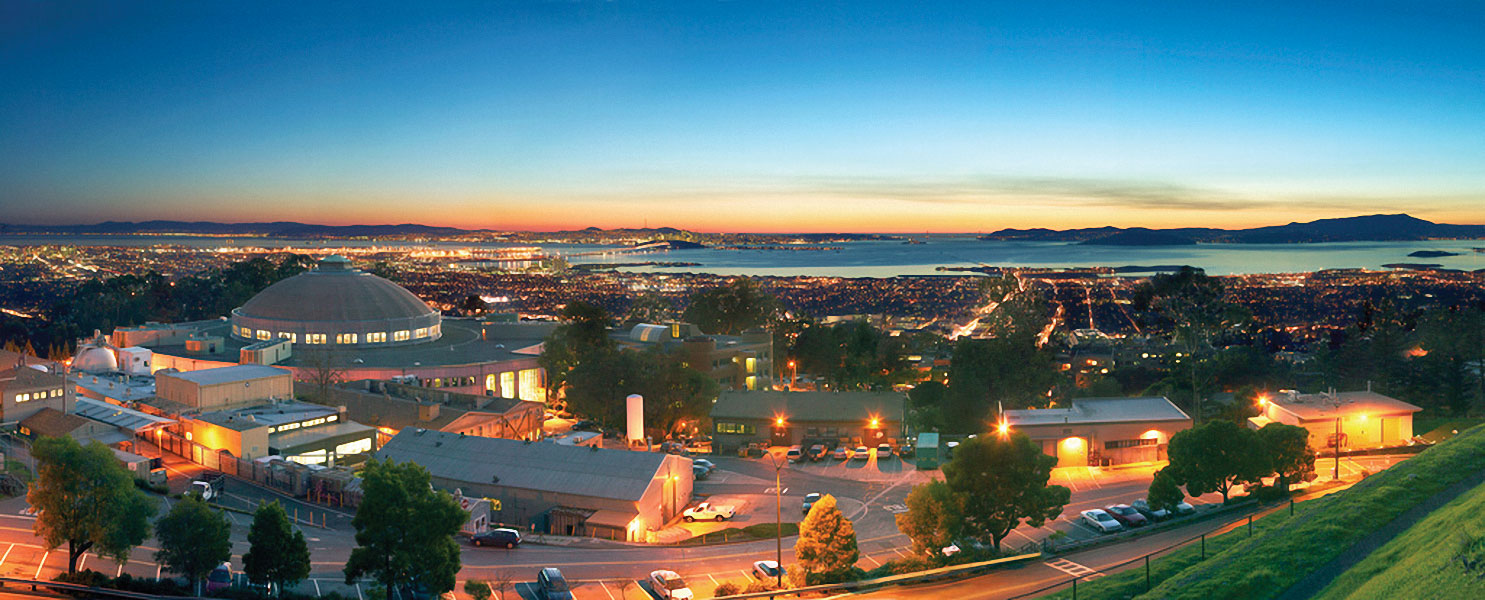

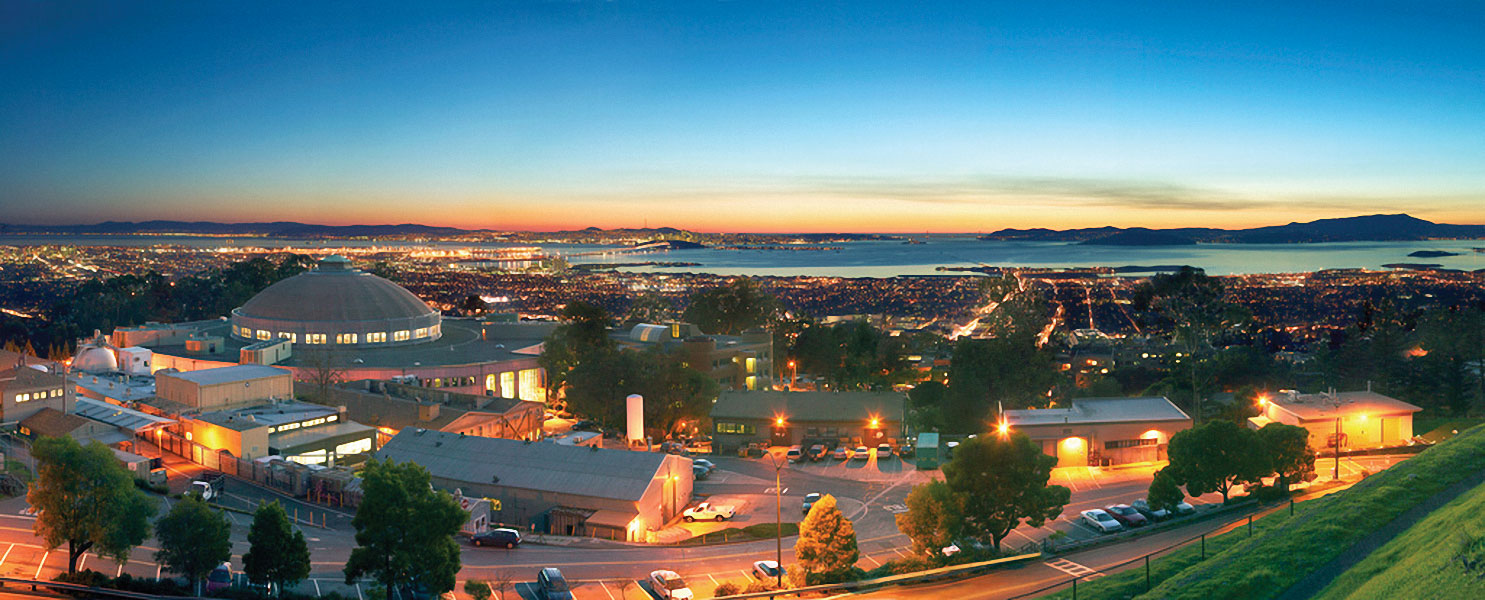

Lawrence Berkeley National Laboratory sits above the City of Berkeley in the East Bay. Photo by Roy Kaltschmidt.

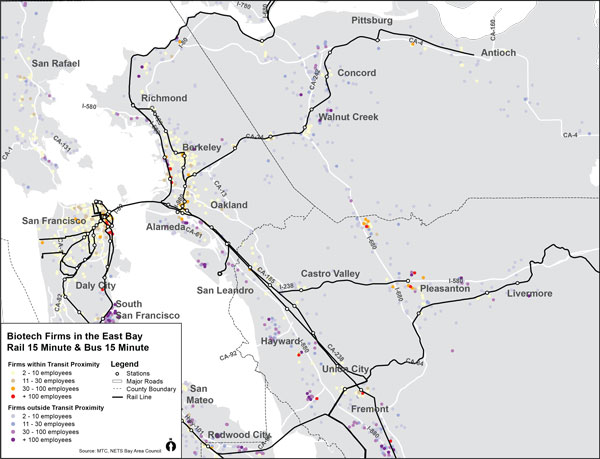

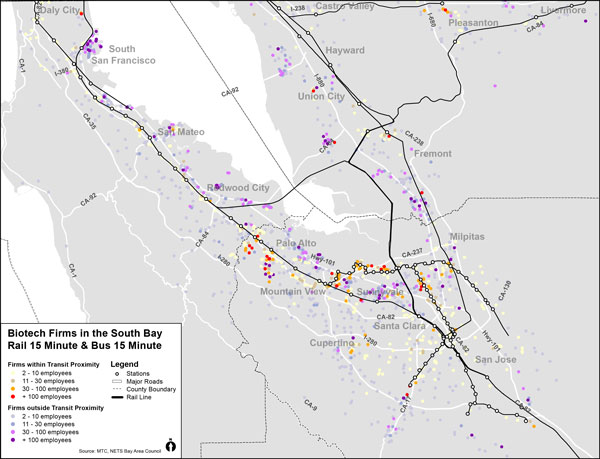

Transit Challenges and Opportunities

Many biotech jobs are located in office parks and research and development parks scattered throughout the region. Research labs often require large-scale spaces and wet lab facilities for experiments. As a result, biotech jobs are low-density compared to the other Industries of Opportunity, as shown at right. However, there are biotech job clusters in several key areas in the region, including heavily industrial areas. In the East Bay, West Berkeley and Emeryville have a small cluster of key firms including Miles, Inc. and Xoma. Fremont has another small cluster near the future Warm Springs BART station. There are small clusters of biotech firms near the San Francisco International Airport and a cluster of healthcare jobs in Palo Alto. Only 27% of biotech jobs in the region are near transit; not surprising given the types of buildings biotech facilities tend to occupy.

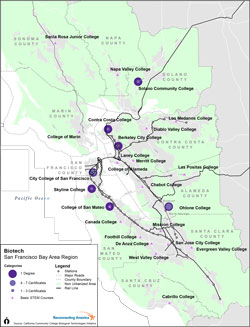

Figure 7. Biotech Firms Proximity to Transit

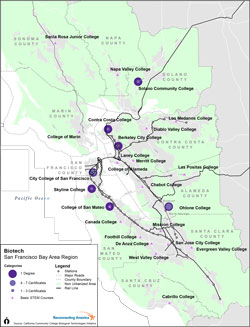

Workforce Profile

Figure 9. Workforce Training Locations in Biotech and STEM courses.

Biotech is a key focus of the Community College Consortium, which is led by 26 Bay Area colleges and 10 economic & workforce development initiatives to increase collaboration on regional priorities, and Biotech certificates and degrees are offered at community colleges in San Mateo, Alameda, San Francisco, Contra Costa and Solano counties. Basic science, technology, engineering, and math (STEM) skills are crucial for biotech jobs. The community college system has been focusing on offering these courses in addition to specialized biotech certificates.

A little under half of the colleges offering these programs are located near transit. Three community colleges that focus on biotech are near transit and nine that offer STEM classes are near transit.

Research on biotech jobs has identified the need for more workers with STEM skills. In addition, there is a need for a more direct career pipeline from workforce training programs to the specific jobs that need to be filled. Part of the challenge is that biotech jobs require significant job experience, which is difficult to attain through formal education. Internships and work study programs will play a key role in addressing this pipeline barrier.

Key Issues

The biotech sector is a new way of clustering industries—including manufacturing, healthcare, and science and research jobs. It may be possible to improve access to these jobs by thinking innovatively about how these industries might operate in more vertical buildings or in environments that link them to transit and major job centers. Compared to manufacturing and transportation and warehousing, biotech offers fewer low-skills positions. Therefore, economic development activities in biotech may need an explicit link to workforce development in order to ensure that industry growth benefits low-income workers.

Biotech Wages and Skill Levels

NAICS

Code |

Description |

% Paying

> $18.50

an hour |

%

Low

Skill |

%

Middle

Skill |

%

High

Skill |

| 3254 | Pharmaceuticals and Medicines | 71% | 16% | 45% | 39% |

| 3345 | Navigational, Measuring, and Control Instruments Manufacturing | 78% | 11% | 36% | 53% |

| 3391 | Medical Equipment and Supplies | 60% | 12% | 67% | 51% |

| 541 | Research and Development | 94% | 4% | 20% | 76% |

| 6215 | Medical and Diagnostic Laboratories | 67% | 25% | 47% | 28% |

In the Bay Area, the energy sector is closely related to biotech but with a focus on clean fuels and green technology and manufacturing. This analysis looked at jobs in utilities and manufacturing, including oil and natural gas extraction, electric power generation and chemical manufacturing. As with biotech, innovative sectors such as green energy are grouped with more traditional firms, so this analysis does not distinguish between jobs in green/clean energy and those in conventional energy. The skills workers need for these jobs are often similar whether the jobs are considered “green” or not.

The economic development field in the Bay Area is focused on energy in part because of the competitive advantage the region has compared to the rest of the U.S. The East Bay Economic Development Alliance (EBEDA) notes that in 2010, the East Bay attracted $355.5 million, or 20.6%, of all U.S. venture investments in clean energy. Only Santa Clara County (Silicon Valley) received more than the East Bay in 2011. There are also major public investments supporting the private investments in this sector. The East Bay hosts the Joint BioEnergy Institute and the Energy Biosciences Institute – making this subregion the nation’s most important center for biofuels research and development.

California is the national leader on investment and innovation in the green economy, and there are efforts underway to link economic development and workforce development efforts to this local dynamism. For example, the San Mateo County Union Community Alliance (SMCUCA) has a focus on green jobs in the energy and utility sectors, particularly PG&E jobs, and provides training in clusters of skills that will allow workers to enter the energy or construction sectors with prospects for upward mobility. Workforce Investment Boards (WIBs) and One-Stop Centers are also targeting energy as a key sector.

In the publication “Community Jobs in the Green Economy”, Urban Habitat and the Apollo Alliance

offer an overview of the kinds of jobs that can truly be quality jobs in this sector and recommend that cities investing in green technologies “attach job quality and job training standards to these types of subsidies to achieve greater public benefit.” This means not only providing a decent income, but also including health benefits and ensuring some percent of the jobs created through public investment go

to community members.

Job Quality

Jobs in the energy sector tend to pay higher average wages than other industries. All of the subsectors analyzed have a majority of jobs paying a living wage; most have over 80% paying a living wage. The majority of energy sector jobs also require middle-skill educational attainment, representing an accessible educational entry point. The majority of energy sector jobs require on-the-job training or an associate’s degree, but others require only a high school degree or GED.

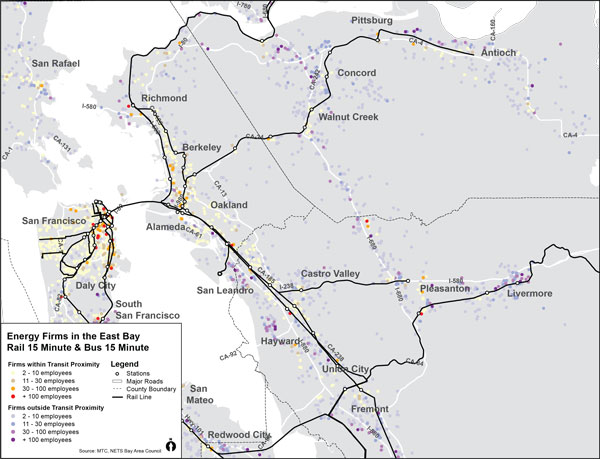

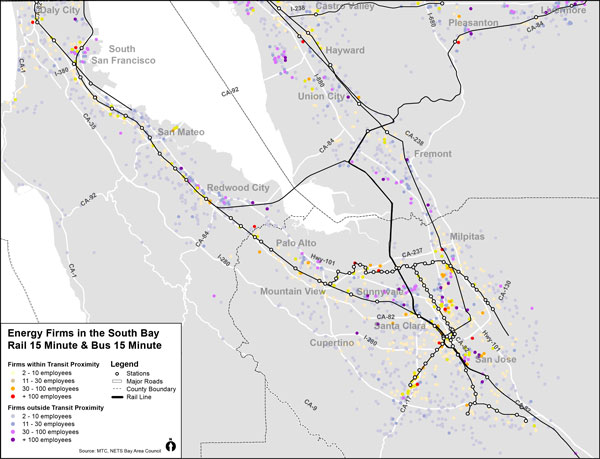

Transit Challenges and Opportunities

Except for major firms such as Chevron and PG&E, energy sector employers are geographically dispersed. Energy ranks as the fourth most geographically concentrated of the six Industries of Opportunity. In East Bay counties, energy job clusters are located in and around Concord, Livermore (home of the Lawrence Livermore National Laboratory), and South Alameda County along I-880—all sites that are not transit-friendly.

In the South Bay, there are clusters of larger energy firms located along the Valley Transportation Authority (VTA) light rail lines.

Of the more than 75,000 jobs in this sector, only 35% (about 26,700) are near transit—about the same share as the manufacturing sector and slightly better than the transportation and warehousing and biotech sectors.

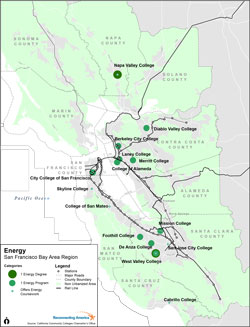

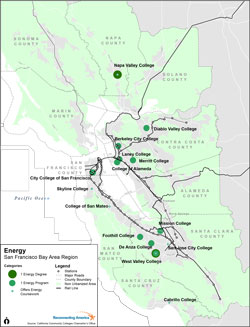

Figure 10. Energy Firms Proximity to Transit

Workforce Profile

Figure 12. Workforce Training Locations in Energy

Workforce providers have focused on green energy both because of its significance to the regional economy and because of the availability of grants and other funding to support skills training in this sector. Only one of the two colleges that offer degrees in energy are near transit. However, seven colleges with energy programs and four with related courses are located near transit.

In the South Bay, NOVA, an employment and training agency, received a 4 million dollar grant to create a solar training program in partnership with the firm SolarTEC. The local One-Stop Center worked with the company and local community college to create a

Figure 11. Relative Density of Industries of Opportunity training curriculum that could serve workers in the industry generally, but also worked closely with SolarTEC to link to trainings and real jobs.

Key Issues

As with the biotech and manufacturing sectors, the physical layout of work spaces and facilities in this sector may make it difficult to cluster employment centers in dense environments. However, there is the potential to better connect laboratory jobs and smaller-scale manufacturing facilities that are part of this sector.

Although “green jobs” have been a buzzword for a number of years, workforce development and economic development professionals should consider all parts of the energy sector in order to maximize benefits to workers and the regional economy.

Energy Wages and Skill Levels

NAICS

Code |

Description |

% Paying

> $18.50

an hour |

%

Low

Skill |

%

Middle

Skill |

%

High

Skill |

| 211 | Oil and Natural Gas Extraction | 83% | 13% | 65% | 22% |

| 2121 | Coal Mining | 82% | 26% | 72% | 2% |

| 2211 | Electric Power Generation, Transmission, Distribution | 94% | 11% | 55% | 34% |

| 2212 | Natural Gas Distribution | 96% | 13% | 59% | 29% |

| 2371 | Utility System Construction | 94% | 13% | 80% | 7% |

| 2382 | Building Equipment Contractors | 87% | 12% | 81% | 7% |

| 324 | Petroleum & Coal Products Manufacturing | 88% | 8% | 67% | 25% |

| 3251 | Basic Chemical Manufacturing | 64% | 20% | 47% | 33% |

Nursing students test their knowledge on a dummy patient at Lower Columbia College. Photo by Wayne Hsieh.

Healthcare is a growing industry in the U.S., and is the industry with the second highest share of jobs in the Bay Area, based on North American Industry Classification System (NAICS) categories, just after Professional, Scientific and Technical Services. Unlike manufacturing and information technology, healthcare is not an industry that sells products outside the region. Because of this, healthcare has not been a focus of efforts by economic development organizations. However, healthcare is a crucial support industry for the region, and unlike retail (another support industry), it offers quality jobs to workers with relatively low educational barriers.

A 2010 Centers of Excellence survey found that healthcare employers in the Bay Area anticipated more than 4,000 new and replacement jobs in ten key allied health occupations over one twelve-month period. These occupations included medical assistants, pharmacy technicians, and medical laboratory technicians. Replacement jobs are especially crucial to track in this industry, since over 50% of job openings in the sector are expected to be replacement jobs. Registered Nurses (RNs) and medical assistants are some of the occupations in the industry with the most jobs and largest number of projected job openings. Occupations including medical records and health information technicians and certified coders are also expected to show significant growth. Research for the Bay Area Community College Consortium found that as the healthcare sector becomes more reliant on new digital technologies, there will be an increasing need for employees with health information technology (health IT) skills.

Job Quality

The majority of jobs in the healthcare sector require more than a high school degree, but few require a college degree or more. Typically, the kinds of jobs at the focus of workforce development and that are in high demand in this sector require an associate’s degree or on-the-job training. Jobs in this sector tend to pay well; more than 70% of workers in hospitals are paid a living wage. However, only 27% of workers in nursing and residential care facilities receive pay at that level. Employers in this industry in the Bay Area often offer on-the-job training for their employees, and say that it is difficult to find skilled workers.

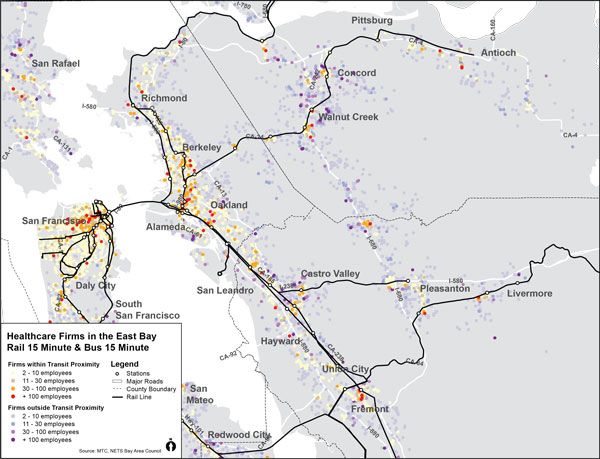

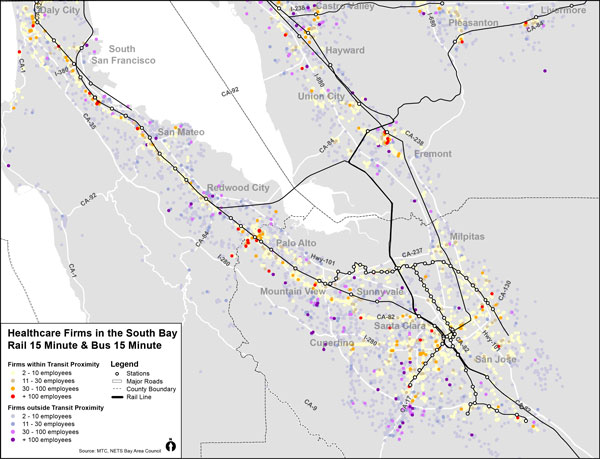

Transit Challenges and Opportunites

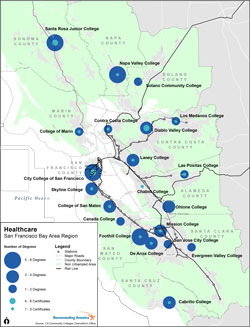

The heathcare sector has the most geographically concentrated job distribution pattern of all the Industries of Opportunity, with major clusters around hospitals and research institutions in San Francisco, Oakland/Berkeley and Palo Alto. There are also clusters near major hospitals in other parts of the region, including Fremont, Walnut Creek and San Jose. Jobs in the healthcare industry are also the most connected to transit of all the industries of opportunity, with 57% of all healthcare jobs located near transit—a higher share of jobs near transit than all jobs in the region. However, because of overnight and off-peak shifts that are typical of many healthcare jobs, they can be some of the hardest to serve with transit that typically runs more frequently during peak commuting hours. Some major healthcare destinations have funded their own shuttle systems to connect employees to the regional transit network as one way to respond to this challenge.

Figure 13. Healthcare firms proximity to transit

Workforce Profile

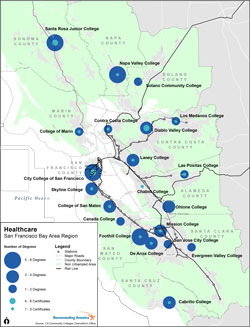

Workforce training locations in healthcare

Heathcare is an industry that has been the focus of workforce development since the 1990s and many community colleges offer degree and certificate programs in this field. For example, the Workforce Development Board of Contra Costa County (WDBCCC) works with the Contra Costa Community College to connect education to job opportunities in the health and life sciences industry. Twenty-one colleges in the Bay Area offer degrees in healthcare occupations, and 17 offer certificates in the field. However, of these colleges, only seven are near transit.

Key Issues

Connections between workforce training providers, community colleges, and employers are not as strong as they should be, and students and trainees do not always know the paths to employment. Coordinated planning among sectors such as healthcare, biotech, and medical equipment manufacturing could help ensure that potential employees understand the educational requirements of occupations and know how to find jobs in their chosen fields.

Kristen Spaulding of SMCUCA points out that “there are a lot of workforce training providers…but there are not enough connections between community colleges/training providers and employers. The pathways are opaque.” SMCUCA is also pushing more innovative thinking about how workforce and economic development stakeholders think of sectors—healthcare and biotech (especially medical equipment manufacturing) for example have much in common and can benefit from co-planning.

Healthcare jobs are some of the easiest to locate near transit and in more compact environments because medical offices do not tend to require the large floor plates or expansive sites that the manufacturing, warehousing, energy and biotech sectors require. Locating healthcare facilities near transit provides benefits not only to healthcare workers but to people using healthcare services. Encouraging new healthcare facilities to located near transit would be a policy with multiple benefits.

Healthcare Wages and Skill Levels

NAICS

Code |

Description |

% Paying

> $18.50

an hour |

%

Low

Skill |

%

Middle

Skill |

%

High

Skill |

| 621 | Ambulatory Health Care Services | 18% | 60% | 22% | 95 |

| 622 | Hospitals | 15% | 67% | 17% | 81 |

| 623 | Nursing & Residential Care Facilities | 41% | 50% | 10% | 102 |

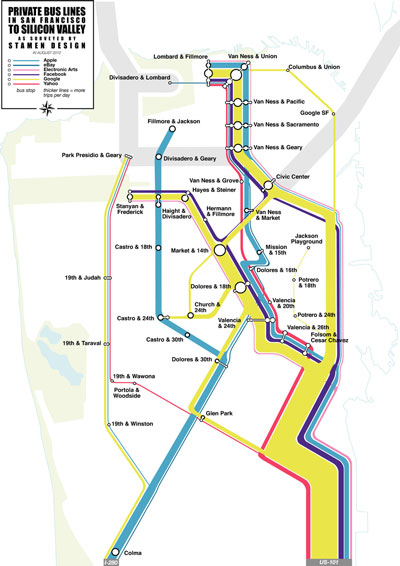

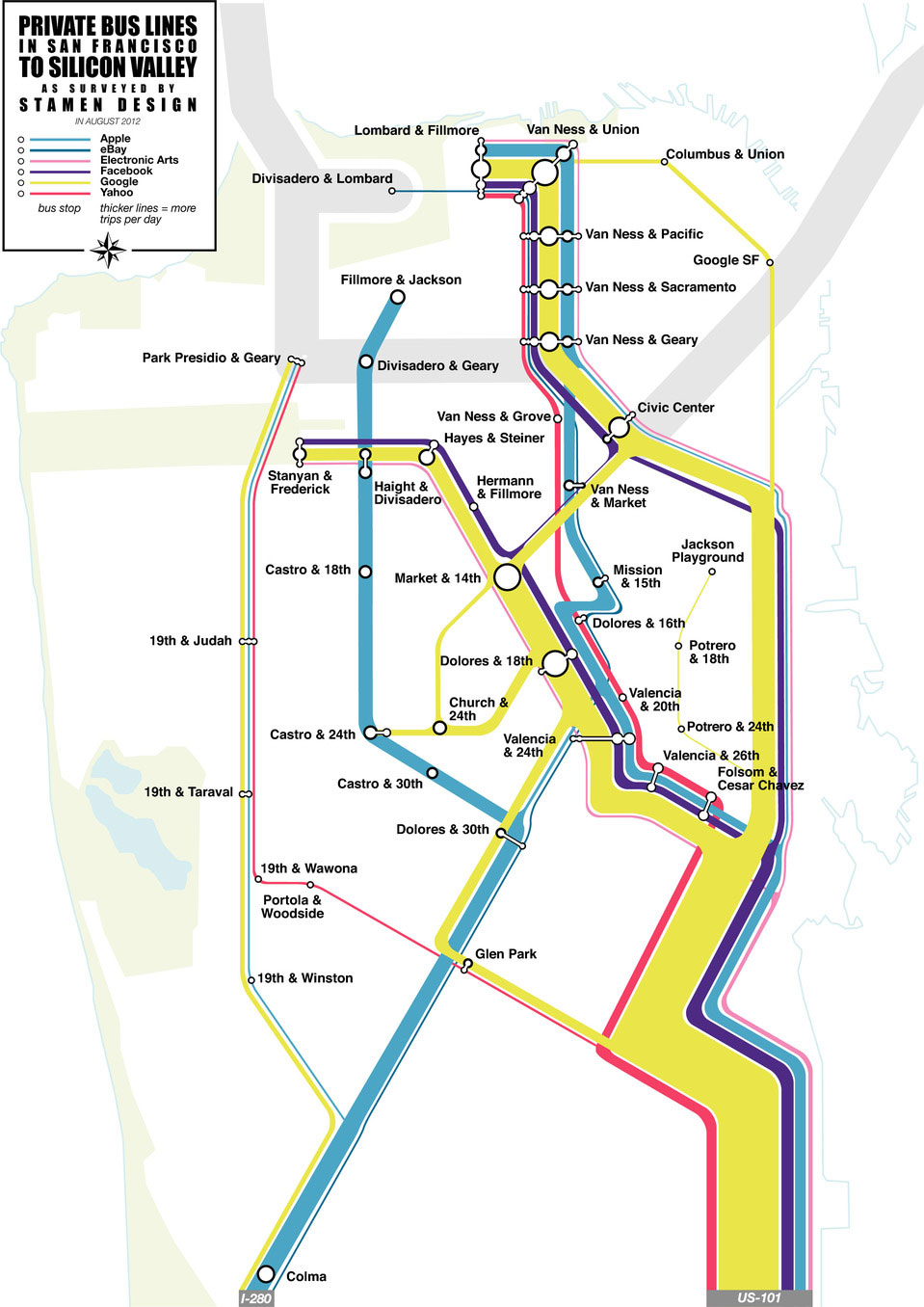

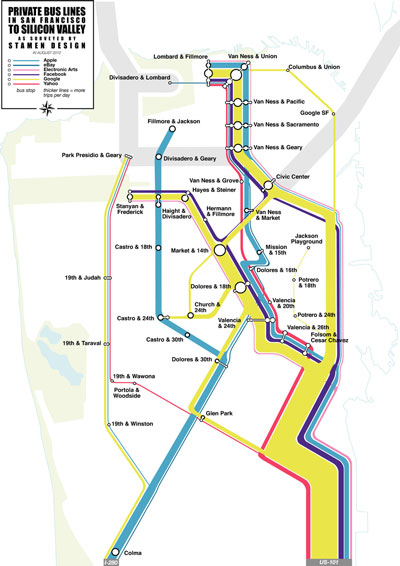

A conceptual map showing the different private buses operated by IT companies to connect their workers to homes in San Francisco.

More than any other industry sector, the Information Technology (IT) or Information and Communications Technology (ICT) sector has defined the Bay Area economy for many years. Information jobs and related jobs in professional, scientific and technical services continue to give the region a strong competitive advantage compared to other regions in the U.S. However, the sector actually encompasses a wide span of occupation types and industries that provide jobs not only to highly educated workers but to workers with less than a college degree. Bay Area workforce development providers have made computer repair positions and jobs accessible to workers with lower skills a major focus of their efforts.

This brief analyzes a broad spectrum of IT-related industries, including software publishers, motion picture production, internet publishing and broadcasting, telecommunications, data processing, computer systems design, computer manufacturing, and electronic repair and maintenance. On average, nearly 30% of Bay Area job openings in these fields are replacement jobs.

While economic development professionals focus on the attraction, creation and expansion of firms specializing in IT, workforce development specialists focus on building skills in IT that are used by workers across all industries. This can make it difficult to coordinate efforts among organizations in economic development and workforce development.

Job Quality

The majority of jobs in IT industries pay a living wage. In some IT industry sectors, over 80% to 90% of jobs offer compensation at this level. Educational requirements for jobs in IT differ among the sectors analyzed. Some have more jobs that require a bachelor’s degree, but most, including electronics repair and maintenance, manufacturing related sectors, and telecommunications in particular have a significant share of jobs that require less than a bachelor’s degree.

The key focus for workforce training providers is on IT support jobs within other industries – repairing computers and systems within offices, etc. Many of the “manufacturing” classified jobs in this industry are in fact not manufacturing based at all, but the classification system has not yet been modified to address this issue.

Transit Challenges and Opportunities

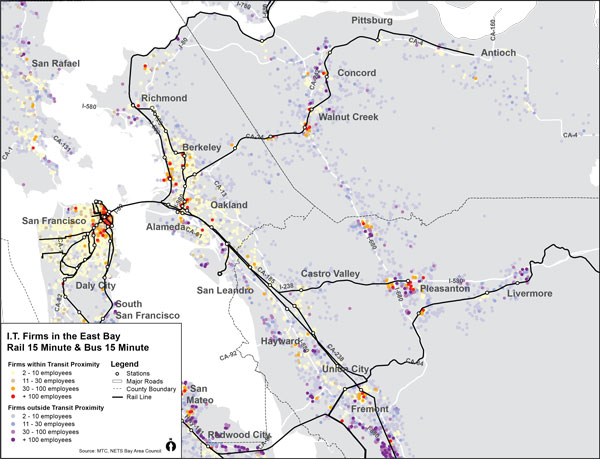

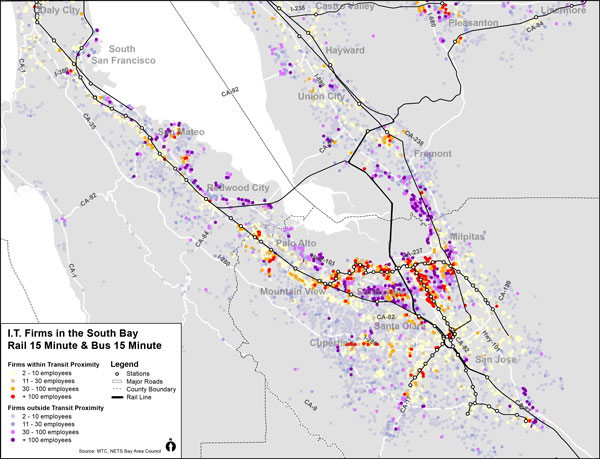

Jobs in IT are the second most geographically concentrated of the Industries of Opportunity, ranking just behind Healthcare. As Figure 16 shows, IT firms are clustered in the Silicon Valley (in North San Jose, Santa Clara, Sunnyvale and up the Peninsula to San Mateo) and San Francisco, with smaller clusters in Oakland, Pleasanton, and around the future Warm Springs BART station in Fremont. Firms in this sector also include key manufacturers of IT-related equipment and parts, which cluster in south Fremont. 51% of jobs in this sector are near transit, providing the second best access after healthcare jobs.

Information technology employers are known in the transit planning world for the massive networks of private shuttles provided by major corporations including Google, Apple, Facebook and Salesforce. These firms boast about the high quality of life provided to their workforce through the shuttle system and other amenities. Indeed, between 40% and 60% of Google and Facebook employees take alternative transportation to work, despite the fact that their relatively low-density campuses are disconnected from the regional transit network and are in locations without a high-quality pedestrian or bicycle network.

There are many smaller firms in this industry that do not have the capital or cashflow to invest in private shuttle networks. These smaller firms compete for the same talented labor pool as the major corporations, and there may be an opportunity to link these smaller firms into the public transit network as a way to help them gain a competitive advantage.

Figure 16. IT firms proximity to transit

Workforce Profile

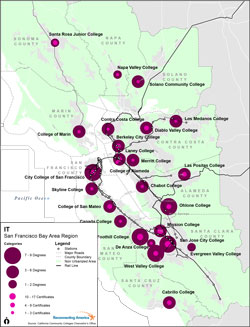

Figure 18: Workforce Training Locations in IT Workforce Profile

Information technology is a special focus for Workforce Investment Boards (WIBs) and community colleges in the Bay Area. As shown in Figure 18, 25 community colleges (include satellite campuses) have certificates and degrees for this sector. However, of those, only 11 degree programs and 12 certificate programs are near transit.

Key Issues

The private shuttle systems of major corporations have played a major role in decreasing automobile trip generation by large campuses. However these shuttles also have their drawbacks: some contract employees must pay to use the services, and if the firms become less profitable over time or move and leave their facilities for other firms, the shuttle services could disappear, leaving major employment facilities disconnected from the public transit network.

Information Technology Wages and Skill Levels

NAICS

Code |

Description |

% Paying

> $18.50

an hour |

%

Low

Skill |

%

Middle

Skill |

%

High

Skill |

| 5112 | Software Publishers | 97% | 3% | 29% | 68% |

| 5121 | Motion Picture and Video Industries | 83% | 20% | 38% | 43% |

| 5161 | Internet Publishing and Broadcasting | N/A | N/A | N/A | N/A |

517 | Telecommunications | 95% | 5% | 67% | 28% |

| 518 | Data Processing, Hosting, and Related Services | 91% | 7% | 41% | 51% |

| 5191 | Other Information Services | 96% | 3% | 25% | 72% |

| 5415 | Computer Systems Design and Related Services | 96% | 4% | 22% | 74% |

| 3341 | Computer and Peripheral Equipment Manufacturing | 93% | 6% | 16% | 79% |

| 3342 | Communications Equipment Manufacturing | 75% | 17% | 39% | 44% |

| 3344 | Semiconductor and Other Electronic Component Manufacturing | 59% | 17% | 48% | 35% |

| 3345 | Navigational, Measuring, Electromedical, and Control Instruments Manufacturing | 78% | 11% | 36% | 53% |

| 8112 | Electronic and Precision Equipment Repair and Maintenance | 83% | 10% | 87% | 4% |

Methodology for Selecting Industries of Opportunity

The following are the values expressed in a 2011 application to the Department of Housing and Urban Development (HUD) Office of Sustainable Communities by the Metropolitan Transportation Commission (MTC), Association of Bay Area Governments, and the Bay Area Consortium. This brief translated those values into a set of quantitative criteria in order to identify “Industries of Opportunity”:

- High share of “living-wage” jobs, industries where many if not most jobs pay at least $18.50 an hour. According to the California Budget Project, in a two working parent family, each person would need to earn $18.15 an hour to meet the cost of living in the Bay Area.

- Job security and low educational barriers to entry: Industries with jobs requiring something more than a high school degree, but less than a bachelor’s degree. These jobs offer both low barriers to entry and job security gained through education or work experience.

- High share of career-ladder positions: Career-ladder jobs are defined as jobs that offer a living wage, job stability, on-the-job training, and opportunities for advancement. Workforce development experts, focus on preparing workers for career-ladder jobs that provide job security by developing transferable skills.

- High number of anticipated job openings: This analysis examined both growing industries and industries where many retirees are anticipated. Healthcare and manufacturing are both included under the latter category.

- High potential to drive regional economic growth: Industries that drive economic growth are important to both workforce development and economic development professionals. Training workers in industries that drive economic growth benefits both job seekers and regional economic prosperity.

- Good transportation connections: Finally, the industries selected for the Moving to Work study had to be ones that could be well-served by transit. Thus, industries where jobs cannot be clustered or are always on the move (especially construction-related industries) were not the focus of this study.

Approach to Identifying Industries of Opportunity

The Moving to Work approach to identifying Industries of Opportunity combined a quantitative analysis of industries with an extensive literature review and discussions with practitioners in the community college, economic development, and workforce development fields. Based on the criteria outlined above:

- The Quantitative analysis looked at how different industry clusters stacked up on the following measures. In each case, the analysis looked for industries that had high shares or numbers of jobs in these categories:

- Jobs qualifying as middle-skill based on State of California Employment Development Department

(EDD) data;

- Jobs paying a living wage of $18.50 per hour based on EDD data (with a focus on middle-wage jobs paying between $18.50 and $30.00 per hour);

- High number of jobs today, and/or high projected job growth, and/or high projected replacement jobs.

- The Qualitative analysis looked to local Bay Area Workforce Investment Boards, community colleges, and economic development agencies, which have recently been identifying industry sectors to target in their work, and are shaping their own programs around these industries to the extent that state regulations allow. The Moving to Work analysis targeted the same sectors to ensure the efforts can be aligned moving forward. Figure 19 shows which sectors are targeted by which actors.

- Sectors targeted by community colleges Figure 19: Industries of Opportunity

- Sectors targeted by economic development agencies

- Sectors targeted by Workforce Investment Boards and other workforce and living wage partners

Limitations of the methodology

Quality jobs are a key focus of this study, but there are other ways of measuring quality beyond wage and educational requirements. In particular, with the datasets available, it was not possible to identify industry clusters that offered good benefits in addition to living wages.

The benefits associated with particular jobs depend on a firm-by-firm analysis, and a database with that information was not available. In addition, while this analysis incorporated a living wage ($18.50/hour) into the analysis, this is a number based on regional needs, and may be higher or lower in some counties.

While the goal of this work was to choose a select number of industries that met the criteria outlined above, we recognize that there are other clusters not identified that may be important components of other workforce development and economic development initiatives. Construction, for example, is one trade that meets many of the criteria identified above, but because the locations of jobs in that industry are always changing and cannot be geographically pinpointed, it did not fit within the parameters of this study.

Download a PDF copy of this brief

Download a PDF copy of this brief